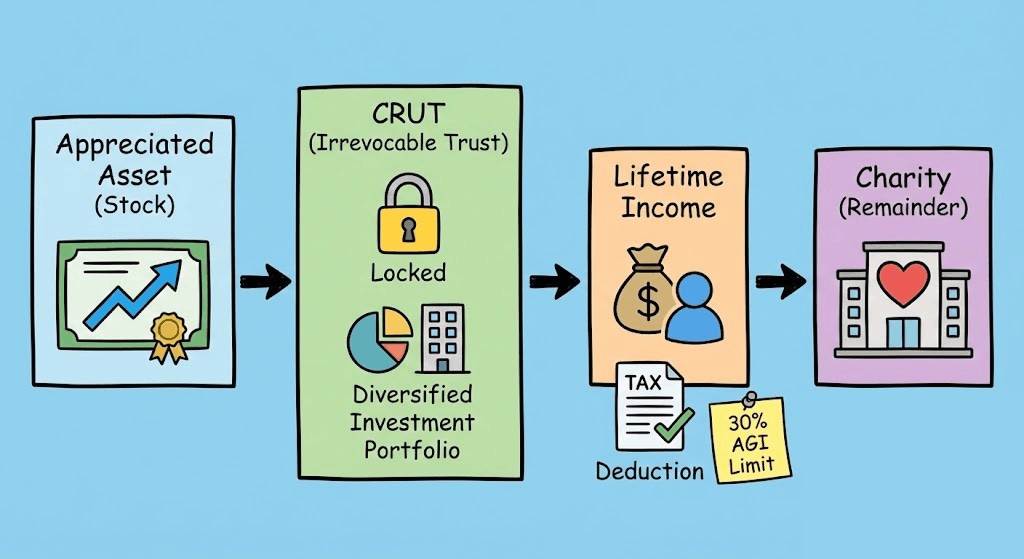

A Charitable Remainder Unitrust (CRUT) is sometimes suggested by financial advisors as a tool to diversify away from a concentrated stock position in a tax-efficient way while also providing lifetime income. This tool is often considered by charitably inclined families who are already planning to give away part of their net worth to causes they care about.

Here is how it works:

An appreciated asset is moved into an irrevocable trust

You receive a charitable income tax deduction in the year of the gift

The trust sells the stock and reinvests it without paying immediate taxes

Each year, you receive a fixed percentage of the trust value (usually 5-8%)

When you pass away, whatever remains in the trust goes to one or more charities you’ve designated.

Here are some nuances:

Once you fund a CRUT, the assets are no longer part of your estate and cannot be taken back. This can reduce estate taxes, but creditor protection varies by state.

CRUT distributions to beneficiaries are taxable. A CRUT generally defers capital gains taxes but does not eliminate them.

The charitable income tax deduction is based on the present value of the remainder interest going to charity. There is a specific IRS formula used to calculate it.

The maximum charitable deduction is limited to 30% of AGI when donating appreciated stock, and you can carry forward any unused portion for up to five years.

Your chosen charities receive the remaining funds only after the CRUT term ends, which may be 20+ years from the date the trust is established.

Why CRUTs Exist

Before 1969, charitable giving through trusts was something of a “Wild West,” leading to potential abuses in which donors took large tax deductions while charities ultimately received very little. To address this, Congress passed the Tax Reform Act of 1969. This landmark legislation created the formal structures we use today, including the CRUT.

The government had two main goals in mind:

Encourage Philanthropy: Lawmakers wanted to provide an incentive (significant tax deductions) to encourage wealthy individuals to fund nonprofits and private foundations.

Ensure Integrity: By creating the 10% remainder rule, the IRS ensured that charities would receive a meaningful benefit. The law mandates that, based on actuarial calculations, the charity must be projected to receive at least 10% of the initial value of the trust.

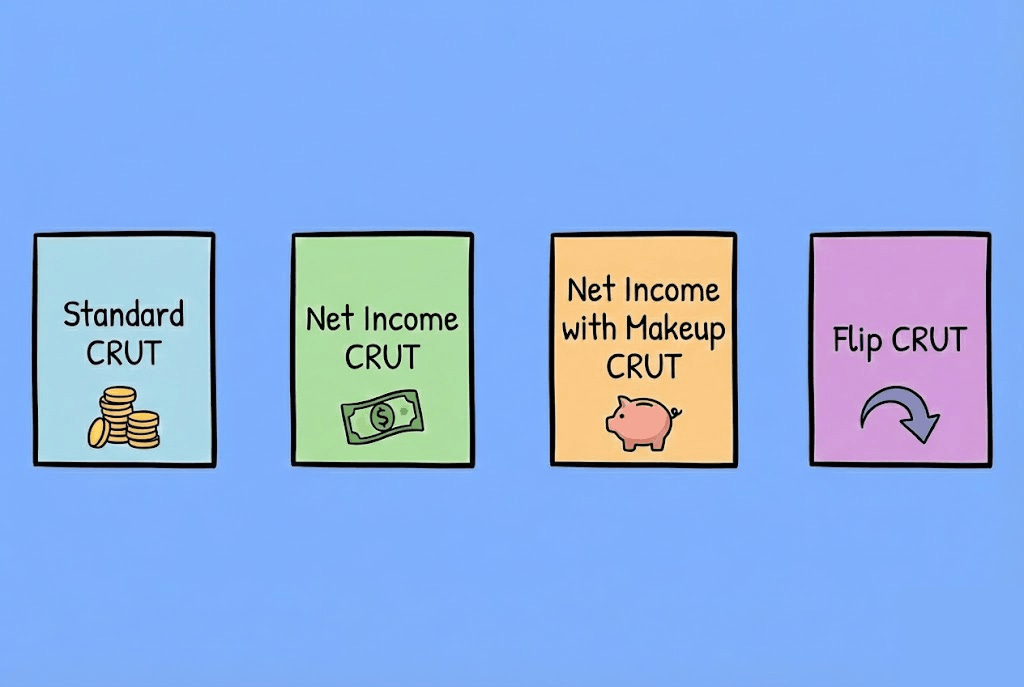

Types of Charitable Remainder Unitrusts

Depending on your liquidity needs and the type of assets you are donating (e.g., public stock vs. real estate), you might choose one of these common structures:

Standard CRUT (S-CRUT): The most straightforward version. You receive a fixed percentage of the trust’s value annually, regardless of whether the trust earned enough income that year. If the trust doesn’t have the cash, it may have to sell assets to pay you.

Net Income CRUT (NICRUT): The trust pays the lesser of the fixed percentage or the actual net income earned by the trust. This is safer for the trust if it holds illiquid assets that don’t produce immediate cash flow.

Net Income with Makeup CRUT (NIMCRUT): Similar to a NICRUT, but if the trust pays out less than the fixed percentage in lean years, it “remembers” the deficit. It can make up those underpayments in future years when the trust has excess income.

Flip CRUT: This starts as a NIMCRUT (perfect for unmarketable assets like real estate) and “flips” into a Standard CRUT after a specific triggering event, such as the sale of the asset.

The CRUT Math

Suppose you have a $3M concentrated stock position with a $300K cost basis. You are a high earner in California with $750K of annual ordinary income.

Option A: Sell the Stock Personally

If you sell the stock today, you face a “triple threat” of taxes on the $2.7M gain:

Federal capital gains tax (20%) = $540K

Net Investment Income Tax (3.8%) = $102.6K

California state tax (12.3%) = $332K

Total tax: 36.1%, or approximately $974.7K

Net proceeds to reinvest: about $2.03M

Option B: The CRUT Strategy

If instead you contribute the appreciated stock to a CRUT, the trust can sell the shares without paying immediate capital gains taxes. The full $3M remains invested.

The capital gains are not eliminated, they are deferred and recognized over time as distributions are made to beneficiaries. It is important to emphasize that a CRUT is a tax-deferral strategy, not a tax-elimination strategy. Here is a simple explanation how deferring capital gains helps.

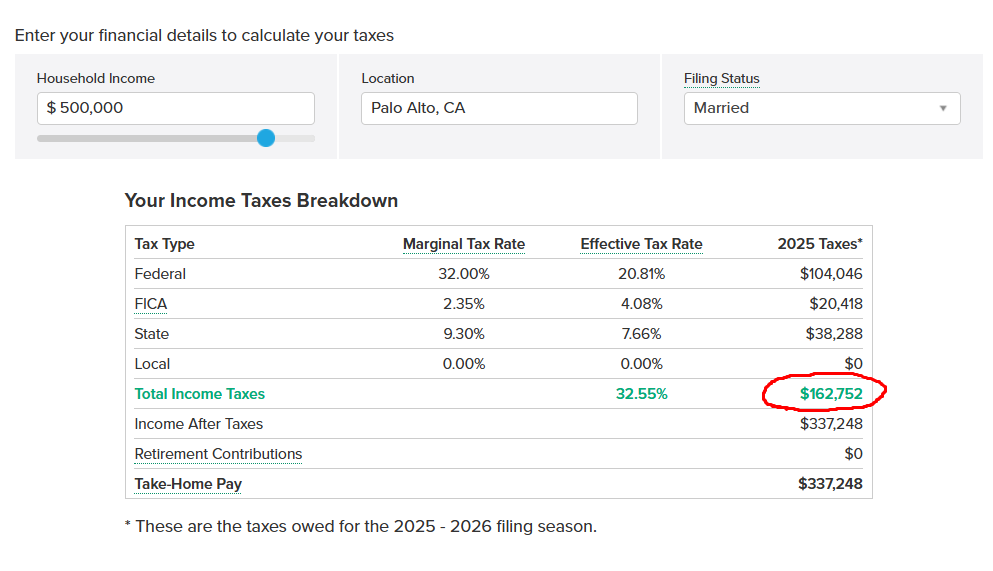

In addition to tax deferral, you receive a charitable income tax deduction. Under the IRC rules, the deduction is subject to limits. Because the family is donating appreciated stock, the annual deduction is capped at 30% of their Adjusted Gross Income (AGI).

With $750K of AGI, you may deduct up to $225K per year. If the calculated value of the charitable remainder interest is, for example, $800K, you can deduct $225K in Year 1 and carry forward the remaining amount for up to five additional years.

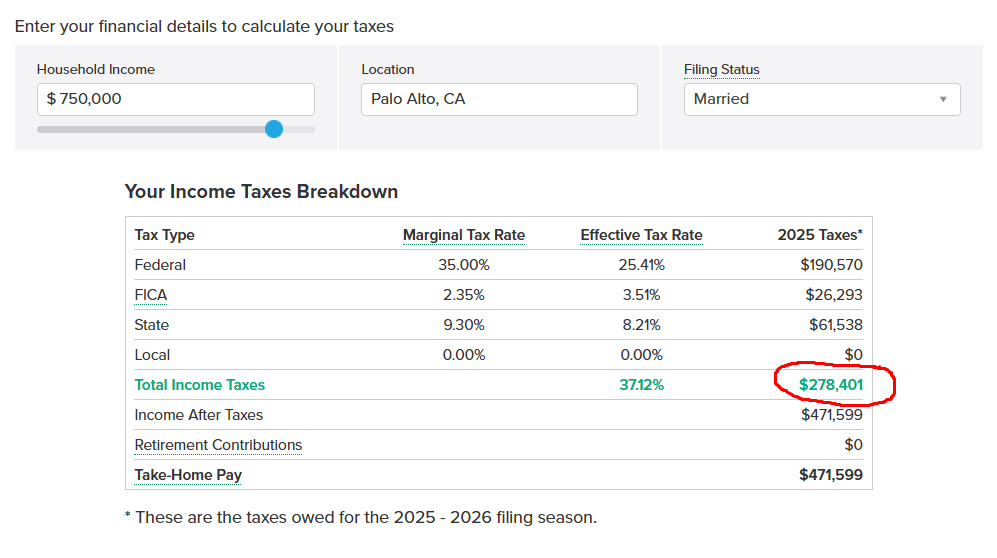

At a $750K income level, your effective tax rate is about 37.13% and total income tax is $278K. By reducing your AGI by $225K, you reduce your total income tax from $278K to $162K which results in a $116K saving in year one. You’ll continue reducing your taxable income until you fully use your charitable income tax deduction which depends on CRUT parameters.

Family Income and Taxes without Charitable Income Tax Deduction

Family Income and Taxes with Charitable Income Tax Deduction Applied

At the same time, you begin receiving annual distributions from the trust. This is where the “unitrust” feature of a CRUT comes into play. Unlike an annuity that pays a fixed dollar amount, a CRUT payout is a fixed percentage of the trust’s value, which is revalued each year (typically on January 1).

If the trust grows, your payout increases. If the market declines, your payout decreases. Here is how the math works in our $3 million example, assuming a 7% payout rate and a 10% annual return:

Year 1:

The trust starts at $3,000,000.

Payout: 7% of $3,000,000 = $210,000.

Year 2:

Assuming the trust earns 10% ($300,000) and pays out $210,000, the new value is $3,090,000.

Payout: 7% of $3,090,000 = $216,300.

Because the assets grow tax-deferred inside the trust, compounding applies to the full $3M rather than the $2.03M you would have had left after a personal sale. Over 20 years, this difference in working capital can result in potentially higher cumulative income, depending on market returns, payout rate, fees, and tax circumstances.

Although the trust itself does not pay income taxes, beneficiaries owe income tax when distributions are received. CRUT taxation follows a tier system, meaning some distributions may be taxed as ordinary income and others as capital gains, depending on the trust’s accumulated tax balances.

Financial Goals Before Tax Optimizations

Before diving into the legal paperwork, you should step back and look at the “big picture.” A CRUT is a tax planning strategy designed to help families with charitable aspirations achieve their financial goals. However, the family must clearly understand those goals before deciding whether to use a CRUT and which assets to contribute.

There are three high-level buckets:

Lifestyle Bucket: Money you need to maintain your standard of living and enjoy your life.

Legacy Bucket: Money you want to leave to children, grandchildren, or other heirs.

Philanthropy Bucket: Money you want to use to make an impact on the world.

Each family balances these buckets differently. Because a CRUT is irrevocable, funding one is effectively a permanent decision to move assets from the unallocated or undecided bucket into the “Lifestyle” and “Philanthropy” buckets. You receive income for yourself now, and the charity receives the remainder later, but your heirs generally will not receive those specific assets.

Before deciding whether to use a CRUT, you would like to project your net worth, income, and expenses using financial planning software, determine how much investment risk you are willing to take, and only then evaluate tax-planning strategies.

Starting with complicated strategies without clear goals and alignment with your partner often leads to unnecessary stress and uncertainty later.

CRUT is not a DIY strategy

A CRUT may be a good strategy if the family decides that they want to donate a portion of its net worth to charity and is comfortable with the fact that the charity will receive the remaining funds after the donors pass away.

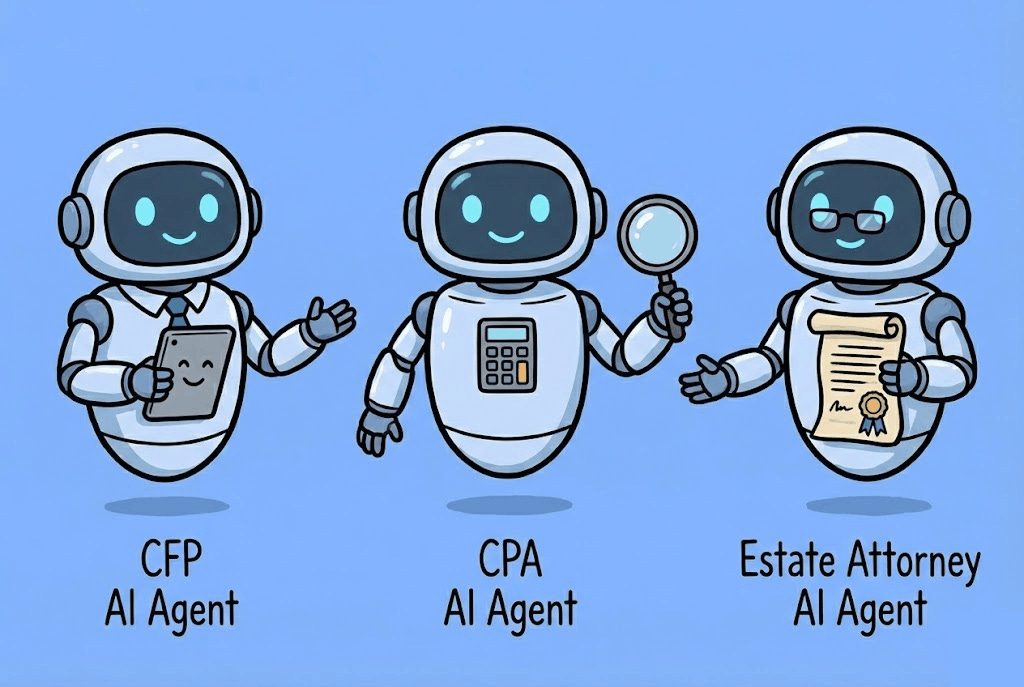

While the benefits are high, the strategy is complex. This is not a DIY project. Setting up and maintaining a CRUT requires a coordinated team:

Estate Attorney: To draft the trust document and ensure it complies with state and federal laws.

CPA: To handle the specialized annual tax filings (Form 5227) and track the “four-tier” accounting rules for distributions.

Financial Advisor (CFP): To manage the internal investments and ensure the payout rate aligns with your long-term cash flow needs.

Between legal setup fees and ongoing administrative costs, a CRUT typically makes the most sense for assets valued at $500,000 or more. If the numbers support it, a CRUT remains one of the most powerful ways to do well while doing good.