This post discusses specific investment products for illustration purposes only. Nothing here should be interpreted as a recommendation to buy or sell any security.

The Problem

Imagine you are already retired or approaching retirement. A fund manager approaches you and offers to reduce volatility (standard deviation) in your portfolio from 12.16% to 10.71%. Returns unchanged or potentially slightly lower. They ask you to pay them $8,000/year. Would you agree?

Most people will probably say no, because the value proposition is vague. It’s not clear how it helps and whether it’s worth the asked price. We can understand the value of $8,000 dollars, but the value of lower volatility, especially when returns may reduce, is much harder to assess.

Yet for retirees, volatility is not an academic concept. It directly affects sequence-of-returns risk, the probability of running out of money, and ultimately the size of the portfolio required to retire with confidence.

In this post, we’ll look at how to approach that cost–benefit tradeoff as a DIY investor and examine an asset class designed explicitly for this purpose: Managed Futures.

What are Managed Futures?

Managed futures strategies were developed to address a practical portfolio problem: how to perform differently when traditional assets struggle, while improving diversification and risk control. They were never intended to replace equities or beat the S&P 500 every year. Their role is defensive: reducing portfolio volatility and improving long-term survivability, particularly during extended market stress.

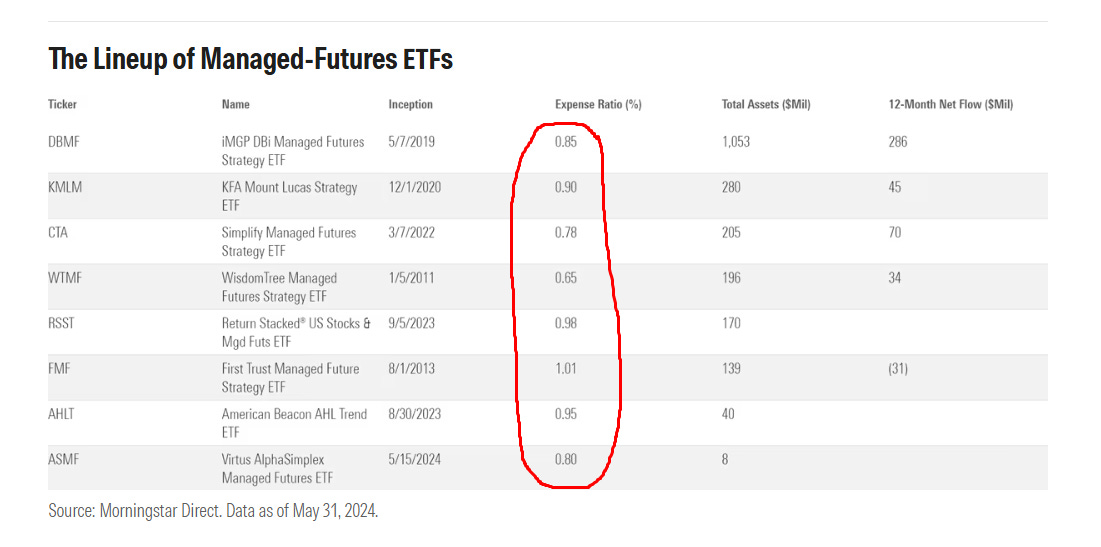

Historically, managed futures strategies were mostly accessible to institutions and ultra-high-net-worth investors. Mutual funds expanded access in the 1990s, and ETFs made them broadly available starting in the 2010s. Early ETF launches include WTMF and FMF (2011–2013), followed by newer funds such as DBMF and RSST in the 2020s.

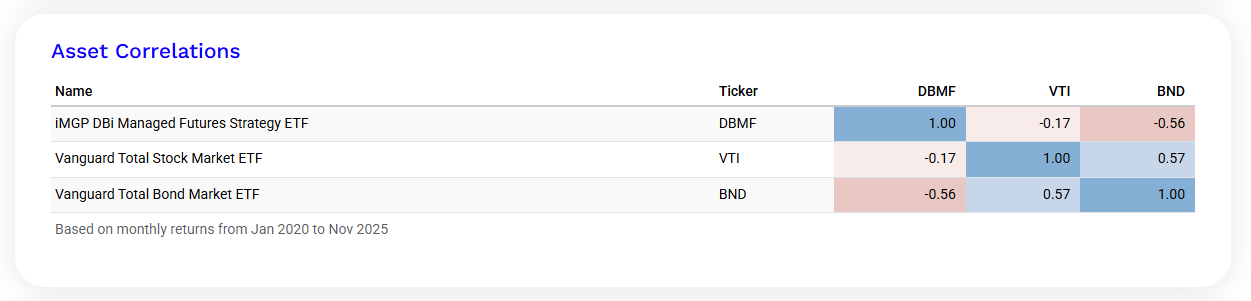

Managed futures have low correlation with the stock market, which can help reduce portfolio volatility. The DBMF ETF, launched in 2019, has shown a lower correlation with the total stock market than bonds (-0.17 vs. 0.57) over the period from January 2020 to November 2025.

Five years is not a long enough period in investing, but the ETF was launched at a very unusual time when the Federal Reserve cut rates and expanded the money supply dramatically, which significantly affected correlations across most major asset classes. During this same period, DBMF showed a -0.17 correlation with VTI.

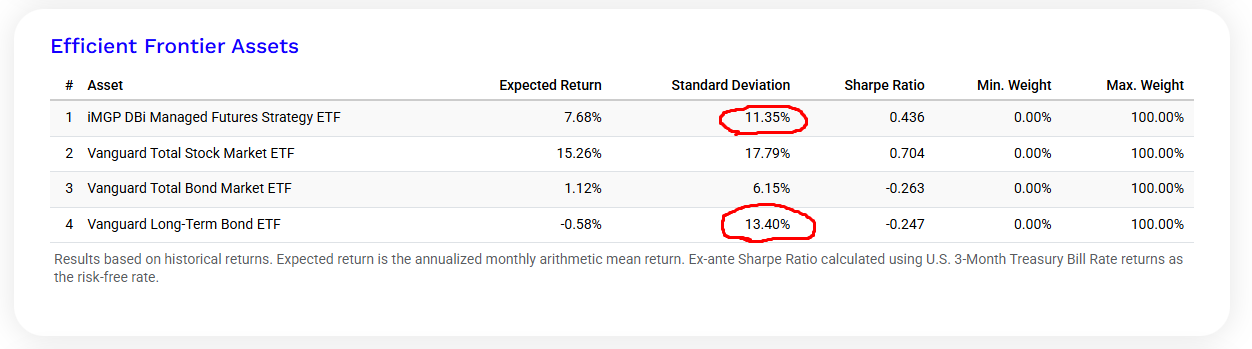

It was also less volatile than long-term bonds:

Fees: The Explicit Cost

Like any financial product, managed futures should be evaluated across three dimensions: benefits, risks, and fees.

Fees are high. Managed futures ETFs typically charge between 0.78% and 1% AUM.

For a $1M investment, that translates to $7,800–$10,000 per year. Because fees are charged as a percentage of assets, the dollar cost grows as the portfolio grows. At a 7–8% annual return, fees compound over time alongside the investment.

High fees do not automatically make a product unattractive, but they demand a clear, measurable benefit.

How Beneficial Are Managed Futures?

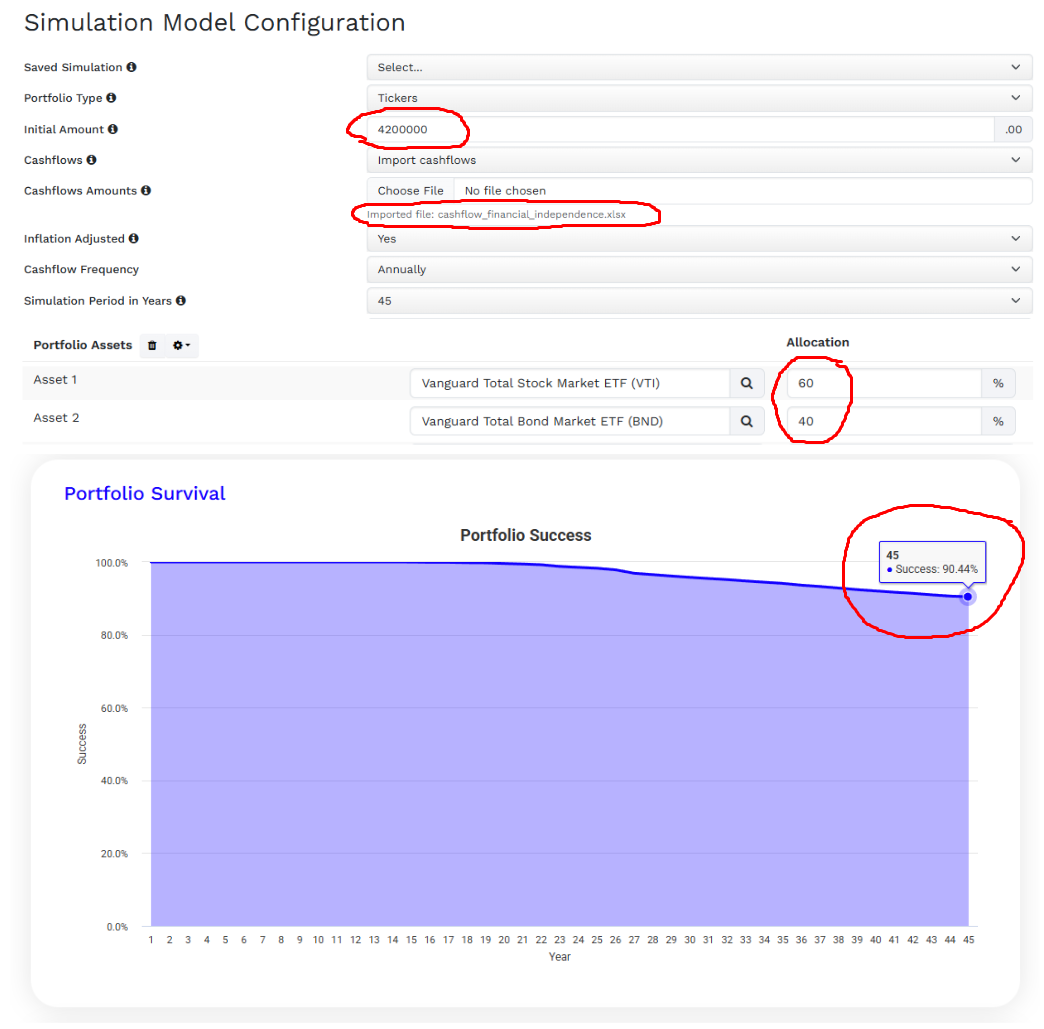

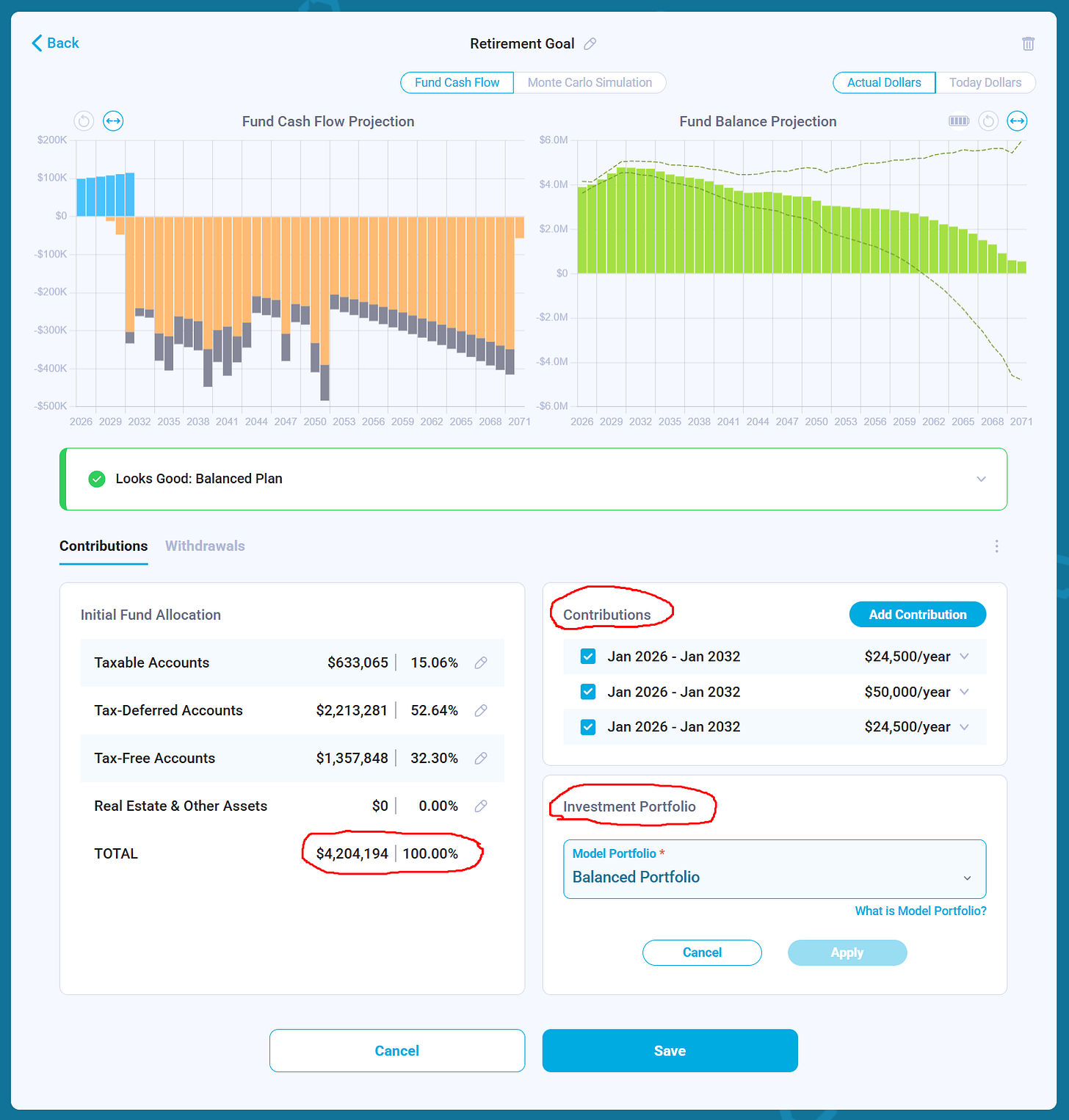

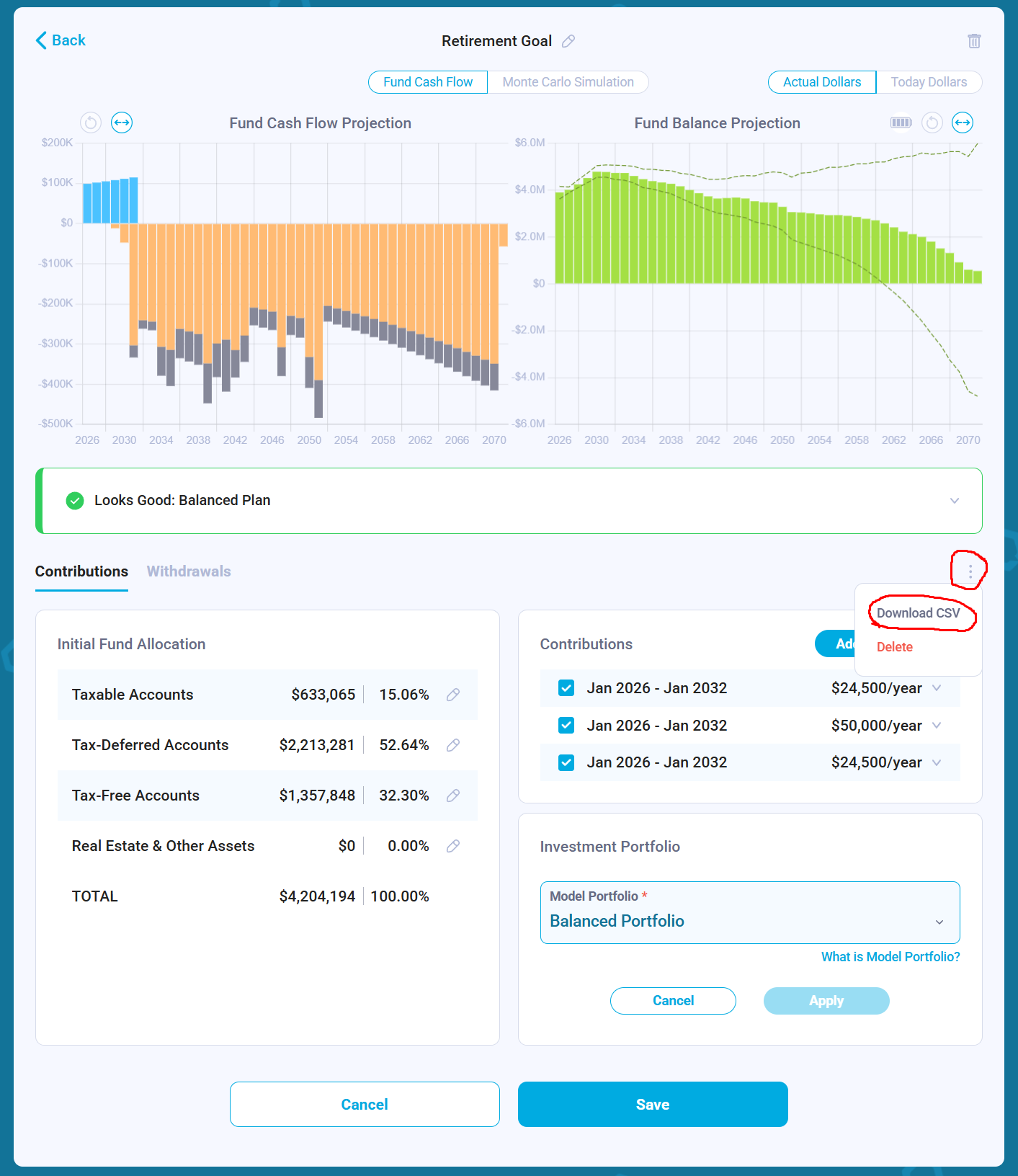

Say, an investor needs a $4.2M portfolio invested in a traditional 60/40 stock–bond allocation to fund retirement with 90% confidence through age 95. They already estimated withdrawals including tax provisioning.

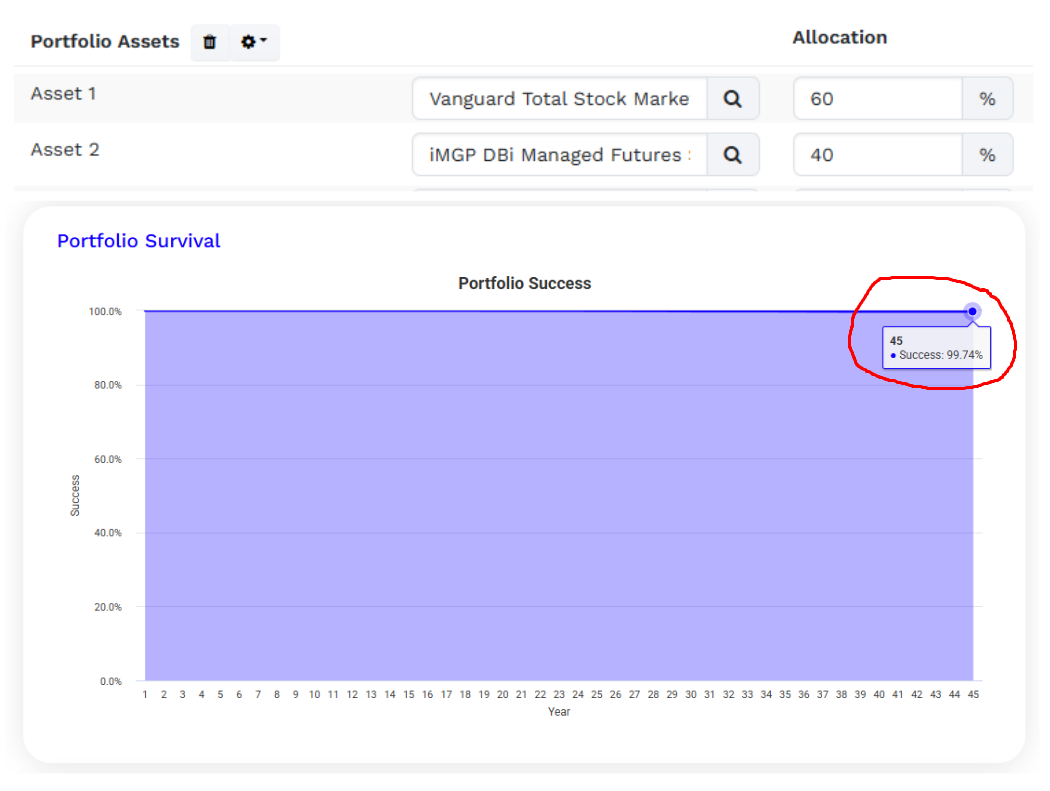

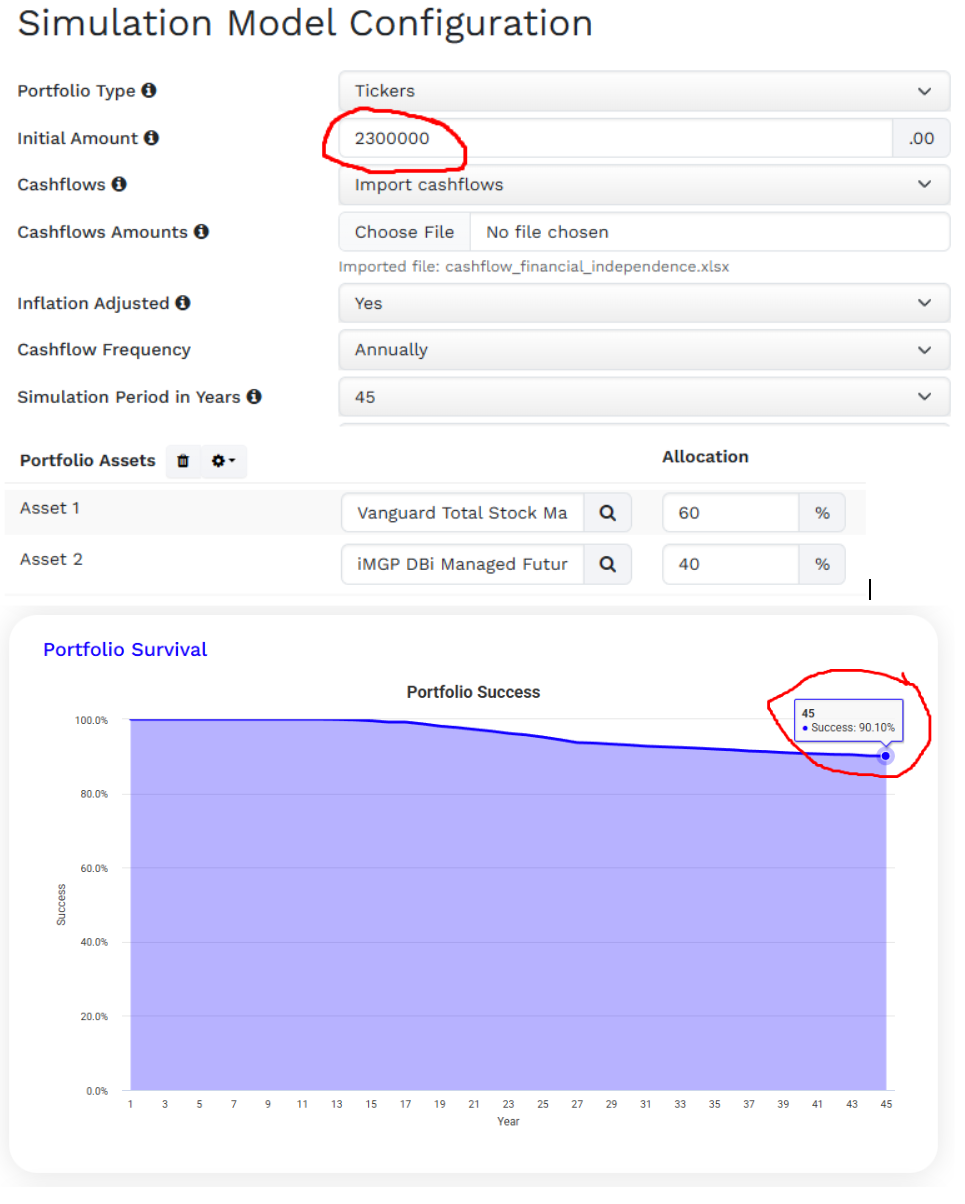

Then the investor replaces the bond allocation with a Managed Futures fund, and that increased portfolio success from 90% to 99% in Monte Carlo simulation for their initial portfolio value and expected cash flow.

If the investor doesn’t need 99% success chance and targets the original 90%, they can reduce the initial fund size. The Monte Carlo simulation analysis suggests that reducing initial portfolio value from $4.2M to approximately $2.3M reduces the portfolio success back to 90%.

That means that by paying the fund a 0.85% annual AUM fee (in this case, applied to 40% of a $2.3M portfolio, or about $7,820 in the first year), the investor can reduce the required initial portfolio from $4.2M to $2.3M.

The math says that investor can free up to $1.9M for other goals (earlier retirement, bigger house, higher spending). In exchange, they pay roughly $8,000+ per year, with fees compounding over time. Over a 45-year retirement with 7% annual growth, total fees paid would be approximately $2.2M.

Viewed this way, the tradeoff becomes much more concrete.

Are Managed Futures Better Than Bonds?

Like bonds, these funds are not designed to generate higher returns but to reduce overall portfolio volatility. The Bogleheads forum seems to be skeptical as the data is still limited. That said, these funds have already been tested during an unusually turbulent period (2020–2025), when the bonds so often recommended failed to provide the diversification and protection against sequence-of-returns risk that many investors expected. During this period, the Total Bond Market Fund declined by 21.19% between December 2020 and October 2022:

The central open question remains whether managed futures can sustain low correlation with equities over multiple decades. There is no definitive answer yet.

Managed futures trade futures contracts across markets, using rules to decide what to buy or sell, how much risk to take, and when to exit. They are about responding to price trends, not forecasting the economy. The underlying strategies trade futures across global markets using systematic, rules-based approaches rather than discretionary decision making by fund managers.

That rules-based structure reduces reliance on human judgment and helps limit behavioral biases, a benefit similar in spirit to index investing.

Estimating Initial Fund Size and Cashflow

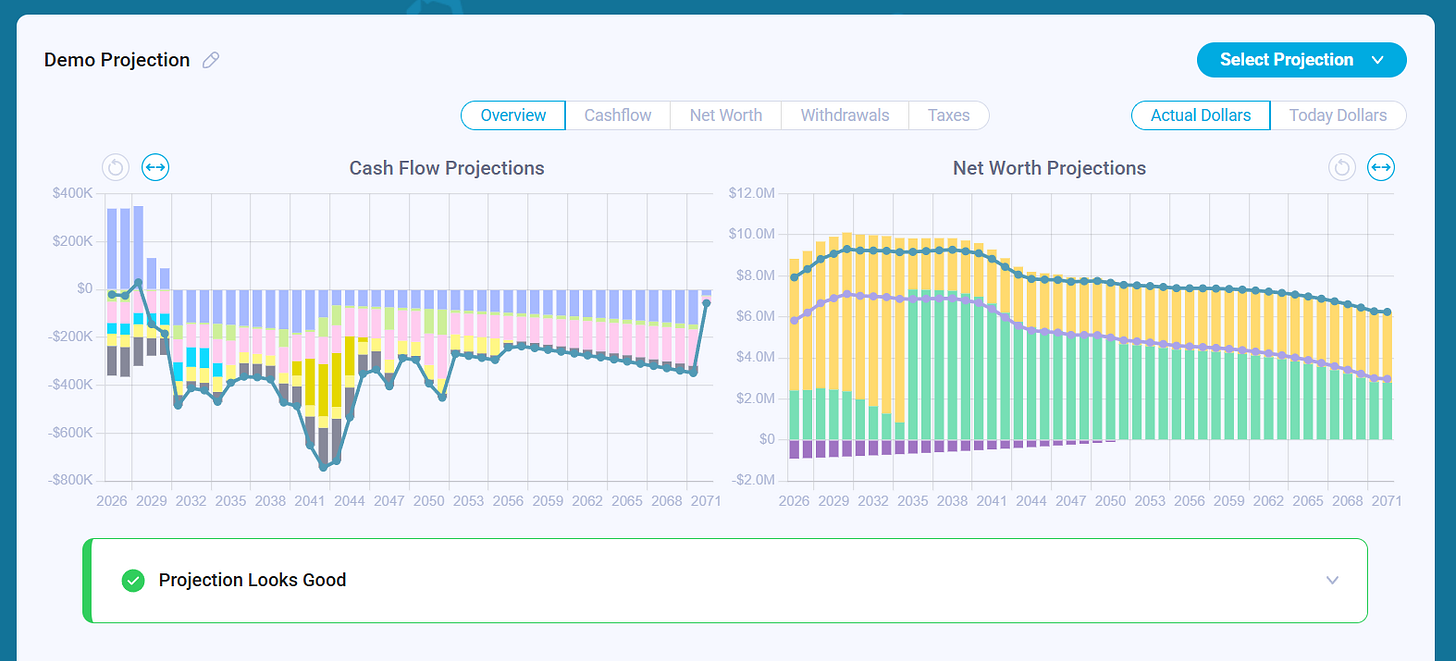

Evaluating strategies like this requires a financial plan, not just return assumptions. The cash flows used in the Monte Carlo simulations above come from a family financial plan built using Nauma.

The process begins by modeling future income, expenses. The platform automatically estimates income taxes and withdrawal provision for taxable, tax-deferred and tax-free accounts:

To estimate contributions and withdrawals for the retirement fund, a financial goal based on projected future income and expenses is created. By adjusting the initial fund size and contributions, you can identify an optimal allocation.

Once cash flows are defined, they can be exported and analyzed using tools such as PortfolioVisualizer to test different asset allocations.

Final Thoughts

Managed Futures value lies in whether they meaningfully reduce portfolio risk in ways that matter for retirees: lower volatility, improved sequence-of-returns protection, and smaller required starting capital.

The right question is not whether managed futures are “good” or “bad,” but whether the risk reduction they offer is worth their cost given your specific goals, timeline, and constraints.