Careers in tech are rarely linear and follow traditional paths. People move from manager to IC, switch between early-stage and big tech companies, take sabbaticals, start their own companies, get laid off, and start over. Compared to many other professions, tech offers unusually high income potential, geographic flexibility, and access to equity-driven upside. According to Deedy Das of Menlo Ventures, more than 10,000 tech workers in Silicon Valley (roughly 2%) made $10M+ during the recent AI boom between 2022 and 2025.

Because of that, the central question for many people in tech is not whether they can earn “enough” money, but how to maximize life opportunities and experiences. At a certain point, an extra dollar of net worth doesn’t meaningfully change day-to-day life: the jump from $100K to $1M is life-changing, but from $10M to $11M often isn’t. Economists call this diminishing marginal utility.

One of the biggest invisible long-term risks for high earners is not financial failure. It’s waking up in the 70s or 80s with unused millions of dollars and the realization that they could have had more experiences in their life when their parents were alive, their kids were young, their energy was higher, and their appetite for trying new things was stronger.

At the same time, work in tech is often more demanding, making it difficult to sustain high compensation levels through a traditional retirement age. Opportunities to create generational wealth are rare, so major career and financial decisions require careful consideration to avoid costly mistakes or unnecessary risks. Balancing these trade-offs is more challenging for people in tech compared to workers with more traditional, linear careers.

The Desire to Start a Company

Tech naturally attracts curious, ambitious, and hardworking people with a strong desire for autonomy. For many of them, high compensation, free food, and even amazing offices with ping-pong tables are not always strong enough incentives to stay.

Starting a company is often considered an alternative to MBA programs and used to gain unique experience. Even when startups fail, founders typically develop a deeper understanding of business and acquire highly sought-after skills that help them land leadership roles at more established companies.

At the same time, starting a company is a major undertaking and long-term commitment that can significantly affect a family’s financial situation. It can become a trampoline for future wealth or a mistake that creates long-term financial stress.

That’s where financial modeling and financial planning tools can help and start to matter.

Startup Success: Setting Realistic Expectations

We’ll be considering tech VC-backed startups rather than traditional businesses. Tech startups are riskier than traditional businesses, require extensive upfront R&D investment, and almost always aim to disrupt existing industries. Because of that, startups often require more time to achieve success and have a higher failure rate.

Traditional businesses have a very different risk/reward profile and a different impact on family finances. Modeling starting a family restaurant or small service business would look very differently from capital requirements and expected cash flow.

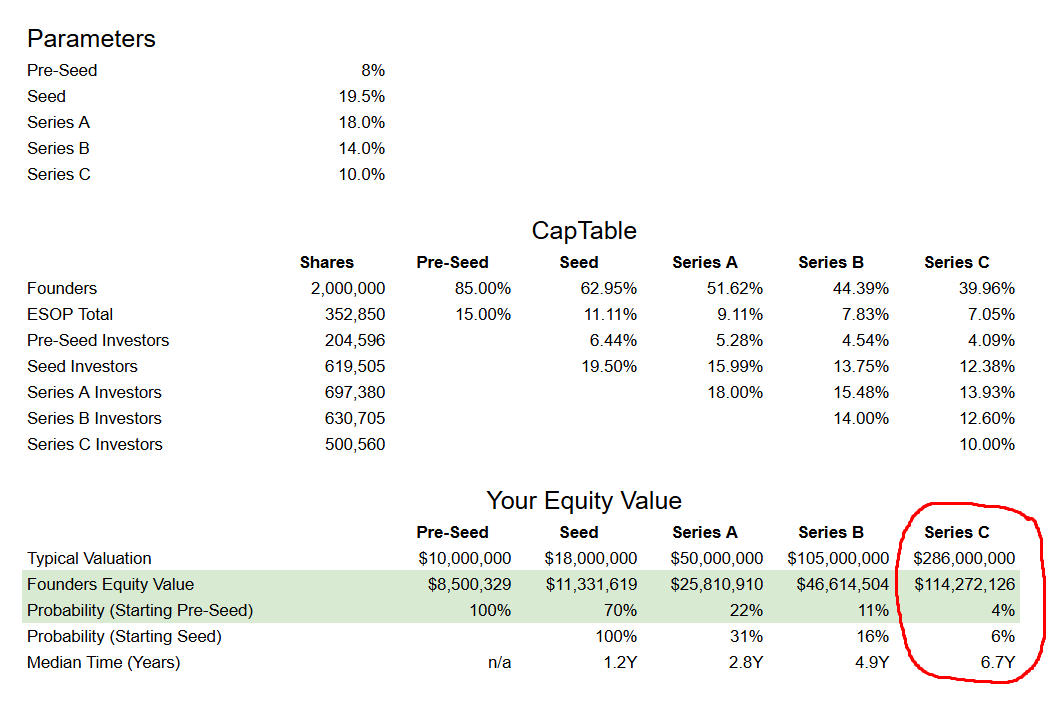

Peter Walker and Carta have been publishing aggregated data for startups hosting their CapTables on the platform. Using their data, I compiled a simple calculator that estimates the value of founder shares given traditional VC dilution and the probability of a VC-backed company reaching each stage.

A few takeaways from that data:

For a median company, it takes 1.2 years to raise a seed round

The probability of reaching Series C (a company is considered to have found PMF and is actively scaling) is 4%.

At Series C, founders normally own 30-40% of the company

If someone is a first-time founder, it’s unlikely that they would be able to raise immediately after quitting their job. They’ll need to reserve funds for 1-3 years to support themselves and potentially their startup if the founder can’t bring angel investors.

According to Peter Walker (link), while VC-backed companies raised more money in 2025, the number of startups raising remained the same, which supports the thesis that fundraising remains hard while large mega rounds often create a distorted impression among founders.

Financial Modeling

Financial modeling doesn’t answer the question “Should I start a company,” but it helps clarify the impact on family finances if someone tries and fails versus continuing to work in big tech. It also helps show how starting a company at different ages and net worth levels affects long-term family finances.

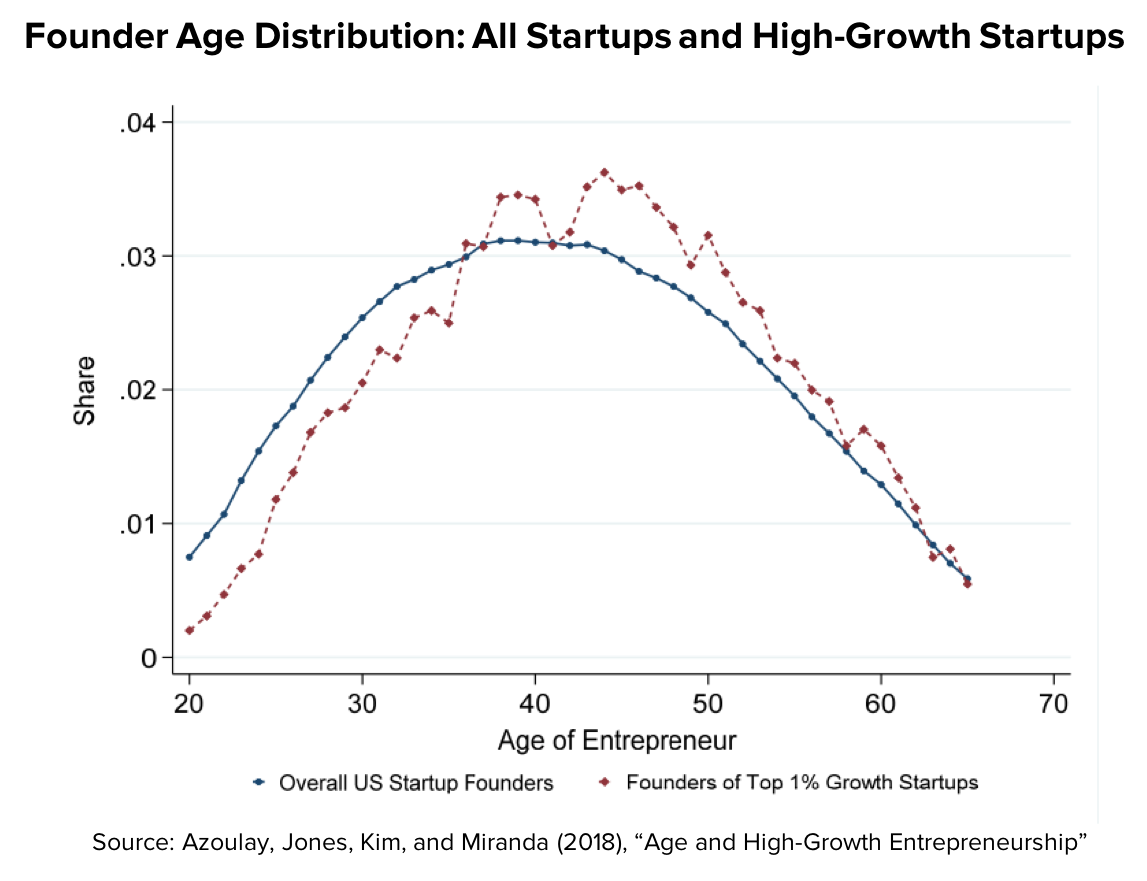

Researchers have known for some time that the peak age for entrepreneurship tends to occur in mid-career, roughly from the mid-30s to the mid-40s, which contrasts sharply with the popular narrative that successful founders are typically twenty-something billionaires.

We’ll consider a hypothetical scenario:

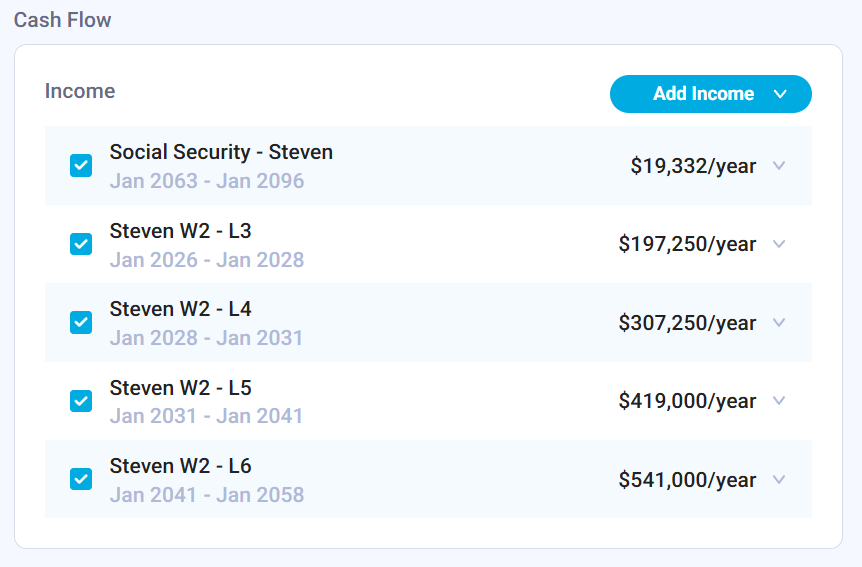

A 25-year-old software engineer living in California who has just joined a top FAANG company as an L3

They have $50K in brokerage accounts and $25K in student loans

They are currently single, but will get married in five years and start filing MFJ

They will have two children at ages 32 and 34

They will be a single-income household and save on daycare costs

They will follow a standard promotion progression:

L3 → L4: 2 years

L4 → L5: 3 years

L5 → L6: 10 years

They will stop working at age 55

Once we build the base scenario, we’ll inject a Startup Life event at different stages of life (ages 25, 35, and 45):

No income for 1 year after starting a company

Moderate income for the next five years, followed by a weak exit

Planning for a weak exit is a good practice in financial planning, as it helps evaluate worst-case scenarios. If the exit is strong, the founder is likely to be financially well off regardless.

We’ll use Nauma to build financial projections for the family and run what-if analyses.

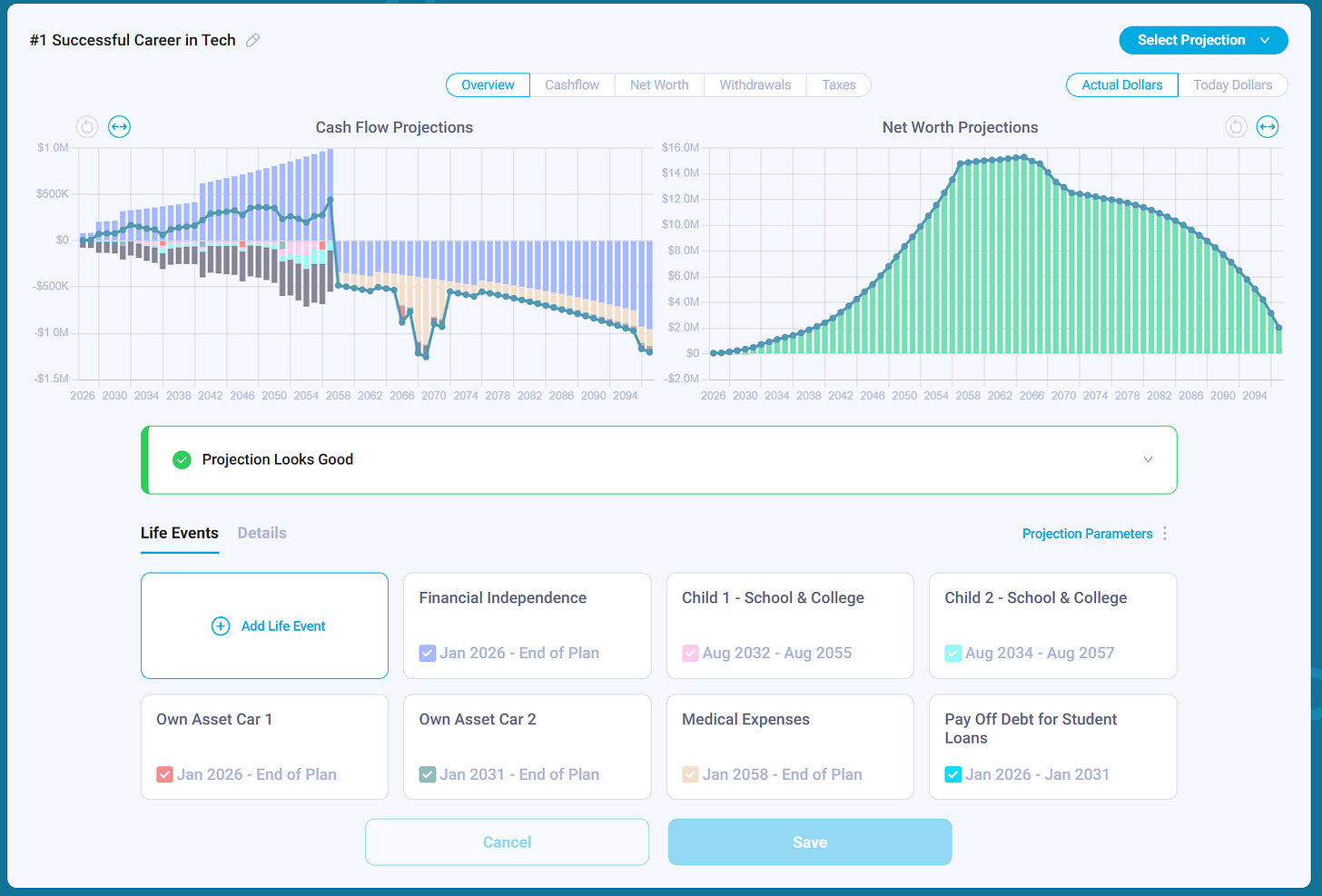

Scenario #1: Successful Career in BigTech

We used Google Salaries from levels.fyi and added 401K company match = $12,250/year to the total compensation, assuming maximized 401k contributions and 50% company match:

It’s generally a good idea to be conservative in financial projections. In this and the other scenarios, we assumed no RSU appreciation between grant and vesting, a 6% annual investment return before retirement and 4% after retirement, and 3% annual inflation.

For simplicity, and to make the scenarios comparable, we assumed the family rents for their entire lifetime. This avoids having to adjust scenarios in which the family could not purchase a home due to lower income and allows for more consistent comparisons across scenarios.

In the first scenario, the family successfully raises two children, funds their college education, travels, and reaches a net worth of $14.7M in 2057, which is equivalent to $5.9M in 2026 dollars.

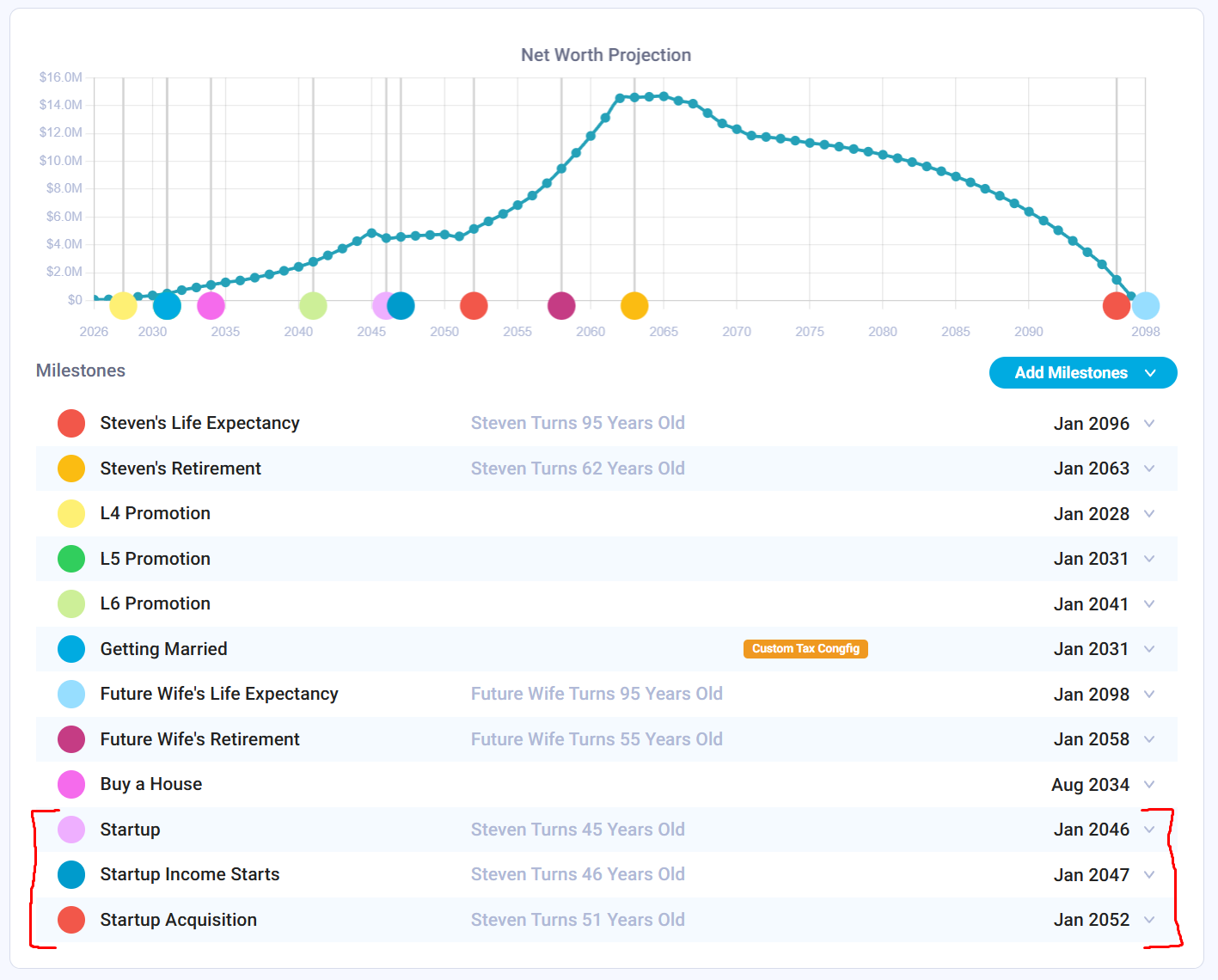

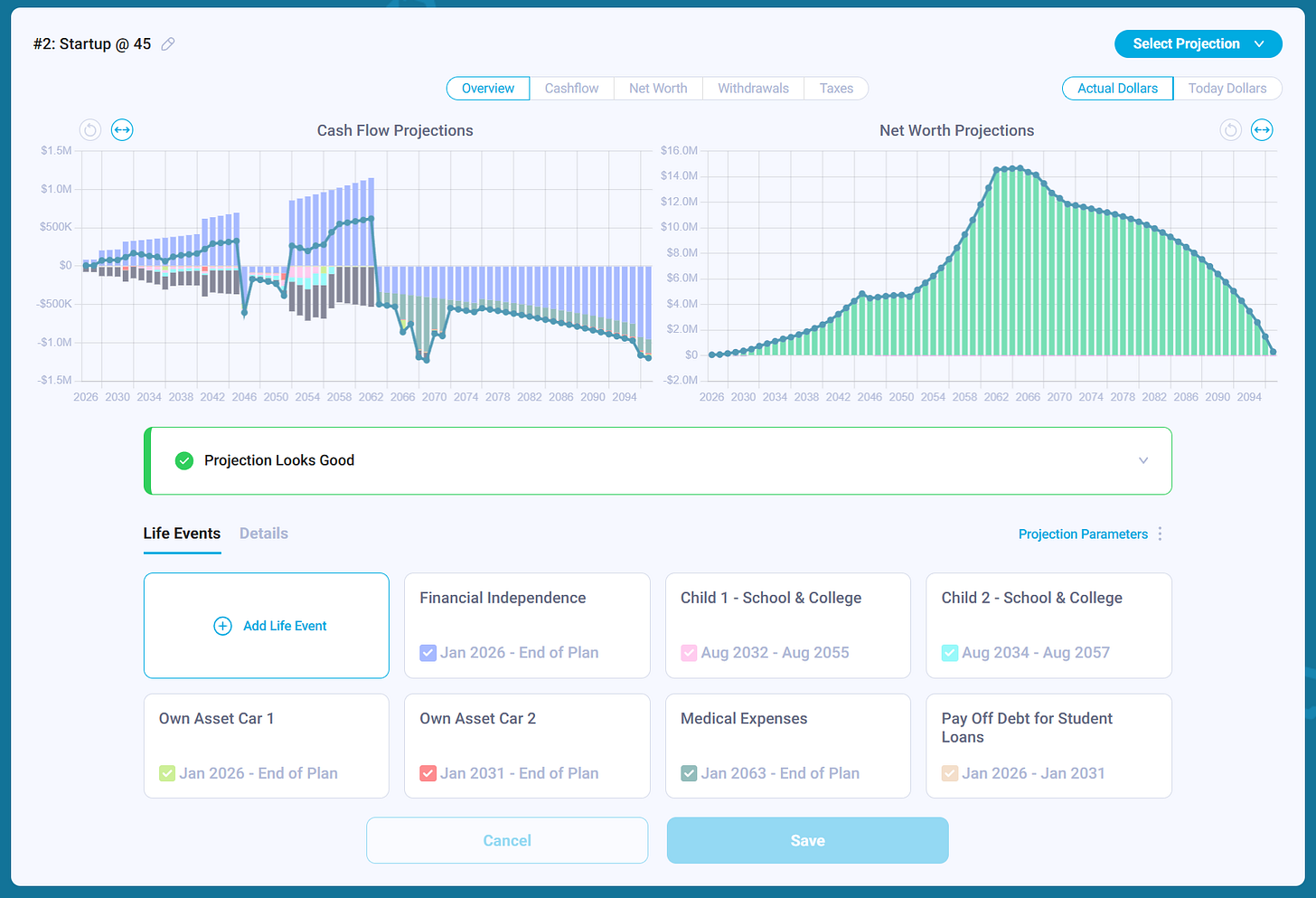

Scenario #2: Tech Startup At 45

We added startup-related milestones to make the financial projections adjustable, using the assumptions described above. In this scenario:

The founder invests $125K of their own capital (equivalent to what Y Combinator provides to its companies).

They work for one year with no income.

In year two, they raise a seed round and begin paying themselves a salary.

They continue working for another five years and experience a weak exit.

To make this scenario viable and avoid running out of money in retirement, we had to increase the retirement age in the model from 55 to 62. Under these assumptions, the family reaches a net worth of $14.5M in 2062, which is equivalent to approximately $5M in 2026 dollars, and is able to cover its expenses.

In this scenario, the founder would need to either work an additional seven years or adjust their lifestyle, such as by relocating from California to a lower-cost area. During the startup phase, the founder family net worth remains flat in nominal (actual) dollars:

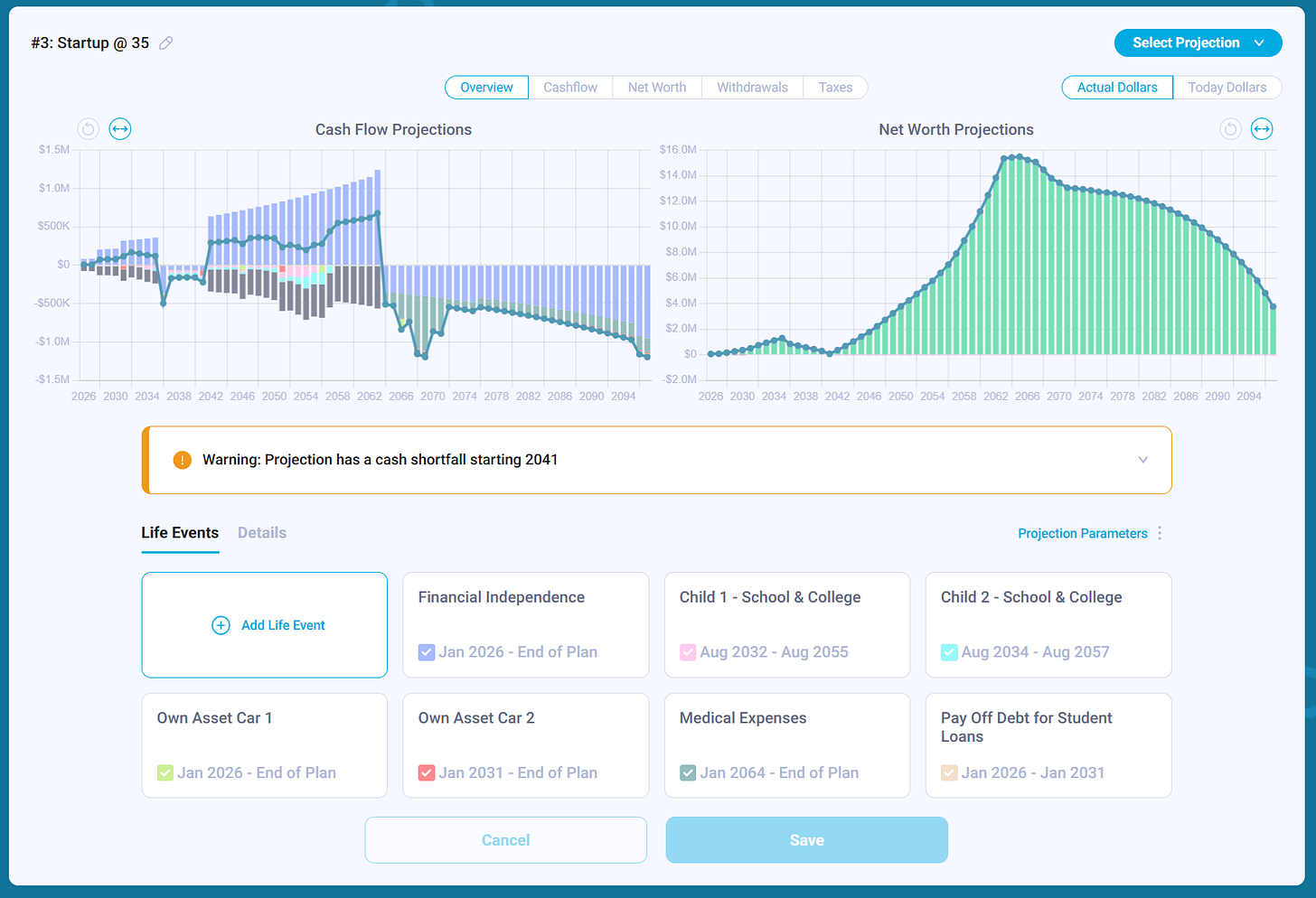

Scenario #3: Tech Startup At 35

In this scenario, we moved all startup-related events 10 years earlier and delayed all W-2 promotions to follow the original schedule: promotion to L4 after 2 years, to L5 after 3 years, and to L6 after 10 years. The founder is still able to invest $125K of their own capital into the company, avoiding the need for fundraising and pre-seed investing, which is often unproductive. However, this decision reduces their net worth to nearly zero by 2041.

After returning to work, the founder gradually rebuilds their net worth. However, as in the previous scenario, they need to work longer than in the original plan and are projected to retire at age 63.

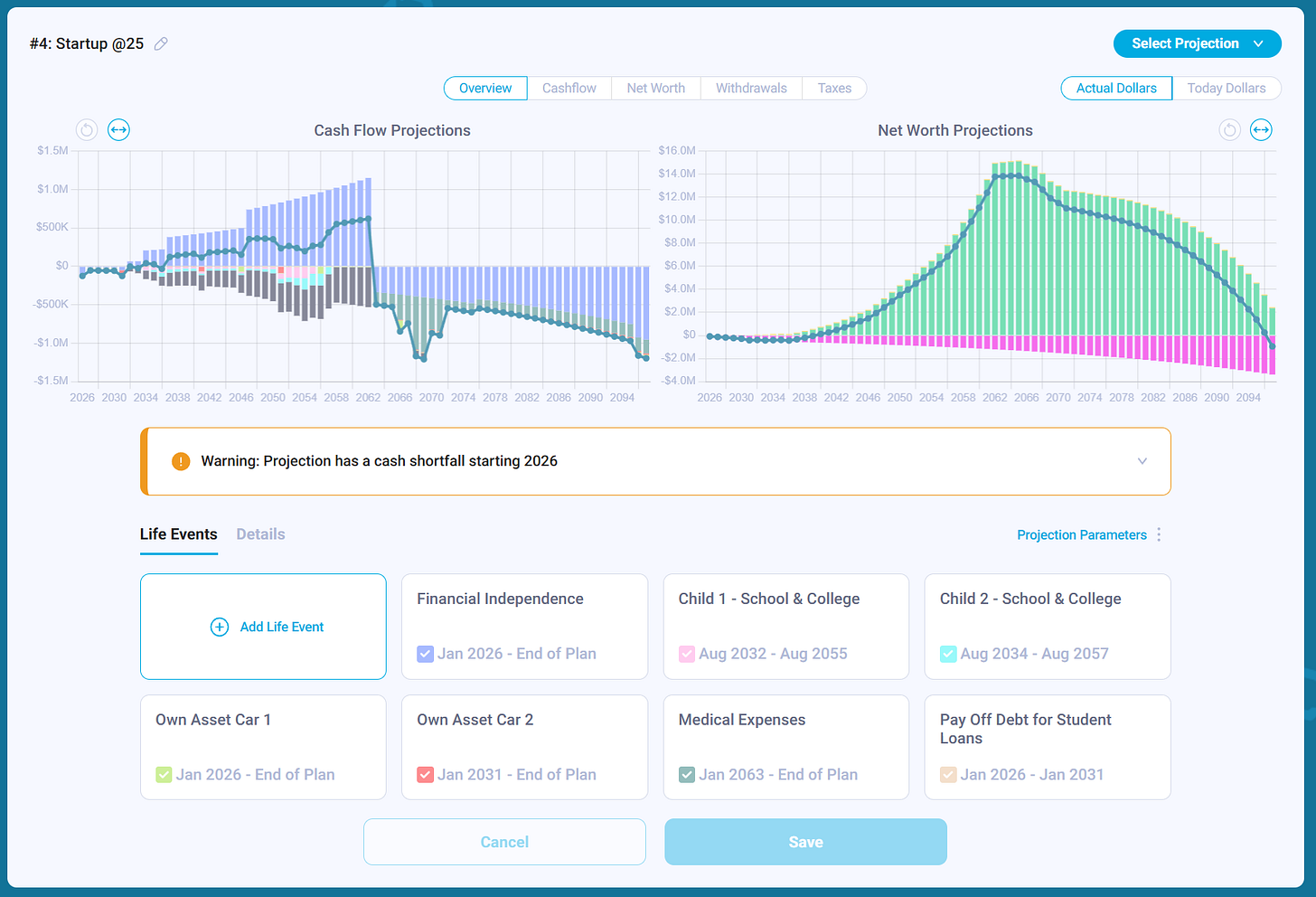

Scenario #4: Tech Startup At 25

This is the most concerning—and arguably the most depressing—scenario, especially given that many startup accelerators encourage young, entrepreneurial students to pursue entrepreneurship early in their careers.

In this scenario, we removed the $125K founder investment because the founder does not have the capital available at the time and instead assumed it is provided by an accelerator. The model shows a negative family net worth until 2040, when the founder turns 40.

Under these assumptions, the founder would need to work until age 62 to retire successfully.

Comparing the Scenarios: Same Decision, Very Different Lives

Looking at the four scenarios side by side, the most important insight is not the final net worth number. In fact, all scenarios eventually “work” on paper if the founder is willing to extend their career, adjust lifestyle expectations, or relocate. The real difference lies in when financial stress occurs and what life stage it collides with.

The same startup outcome, a few years of low or no income followed by a weak exit, feels radically different depending on whether it happens at 25, 35, or 45.

At 45, the startup period overlaps with years when kids are older, college costs are approaching, and parents may begin needing financial or emotional support. At the same time, founders at this age often have a strong professional network, established reputation, and deep domain knowledge, all of which can make building a business meaningfully easier than earlier in their career.

At 35, the picture is mixed. The founder has more skills, credibility, and savings than at 25, but the startup phase coincides with young children, peak childcare expenses, and a household that is often dependent on a single income. The recovery is possible, but the opportunity cost compounds quietly: missed promotions, delayed compounding, and a longer path back to financial stability.

At 25, the startup appears deceptively “cheap” from a lifestyle perspective—no kids, fewer fixed expenses, and more tolerance for uncertainty. But this is also when financial fragility is highest. A prolonged period of negative net worth early in life has long-lasting effects: delayed investing, delayed home ownership, delayed optionality. What feels like freedom in the moment often converts into lost compounding that cannot be fully recovered later.

Experiences Are Age-Dependent, Not Just Wealth-Dependent

Another subtle but critical insight is that experiences are not fungible across time.

A sabbatical at 45 is not the same as a sabbatical at 25. Traveling extensively with young kids is not the same as traveling before kids or after they leave home. Starting a company when your identity is still forming is a fundamentally different psychological experience than doing it after 15–20 years in a structured environment.

Some experiences become more meaningful with age. Others become harder, more expensive, or simply impossible.

This is why optimizing purely for “maximum net worth” is often the wrong objective. A plan that leaves someone extremely wealthy but exhausted, risk-averse, or constrained during their healthiest decades may look successful financially while failing experientially.

P.S. If you want to explore these trade-offs using your own inputs, tools like Nauma are designed to help you build and stress-test different scenarios.

For those who want help going deeper, we also work with a small number of clients to build custom models tailored to their career, family, and risk profile. We currently have limited availability in February and March. Details are here.