An investor is looking to access $1.3M for personal needs. They are considering two options:

Sell appreciated RSUs

Use a Variable Prepaid Forward (VPF) Contract

The cost basis of their stock is $250K, and the marginal long-term capital gains (LTCG) tax rate is 30.8% (20% Federal + 7% WA State + 3.8% NIIT). If they sell, they’ll need to set aside $468K for taxes, meaning they’ll have to sell a total of $1.77M worth of stock to net $1.3M after taxes.

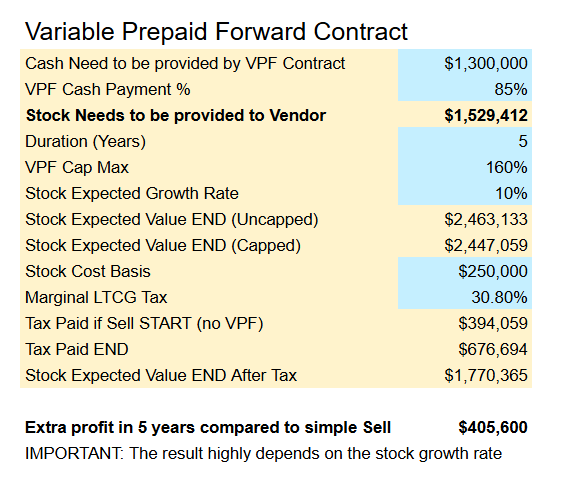

VPF Math

Another option is to use a VPF contract, a tax-deferral strategy often used by investors holding appreciated stock.

In this arrangement, the investor enters into a contract with a financial institution and agrees to deliver a variable number of shares in the future. In return, the investor receives an upfront cash payment, typically between 75–90% of the current stock value. The discounted stock price is the fees the investor pays to the financial institution. The number of shares ultimately delivered depends on the stock’s performance.

Let’s consider a hypothetical example:

VPF Cash Payment: 85%

Stock provided to the institution: $1.53M (to receive $1.3M)

Expected stock growth rate: 10%

Time period: 5 years

Expected stock value after 5 years: $2.46M

VPF contracts typically use a collar strategy that sets a floor of 80% and a cap of 160%. This means the stock will be effectively sold at the 160% cap, or $2.44M. Assuming the marginal tax rate remains the same at 30.8%, the tax paid after 5 years would be $676K.

The additional profit the investor earns would be calculated as:

$2.44M - ($676K - $394K) - $1.52M - $229K = $406K, where:

$2.44M = stock sale value

$676K = LTCG tax paid after 5 years

$394K = LTCG tax that would have been paid today if not using VPF

$1.52M = stock value pledged to the financial institution

$229K = VPF fees (cash discount)

This math assumes the stock grows 10% annually. If the stock falls or remains flat, the investor loses $229K (the VPF fee).

Risk/Return Tradeoff

Now, with this calculator we can see the risk/reward tradeoff of the VPF Contract:

The investor gains $406K on a $1.52M asset over 5 years if the stock grows 10% or more.

The investor gains $62K on a $1.52M asset over 5 years if the stock grows 5%.

The investor loses $229K on a $1.52M asset over 5 years if the stock doesn’t grow.

The math shows that a VPF increases portfolio risk compared to selling today, but reduces downside risk relative to simply holding the appreciated stock, since the contract sets the floor at 80%. We can visualize it by putting these options on the risk/return chart:

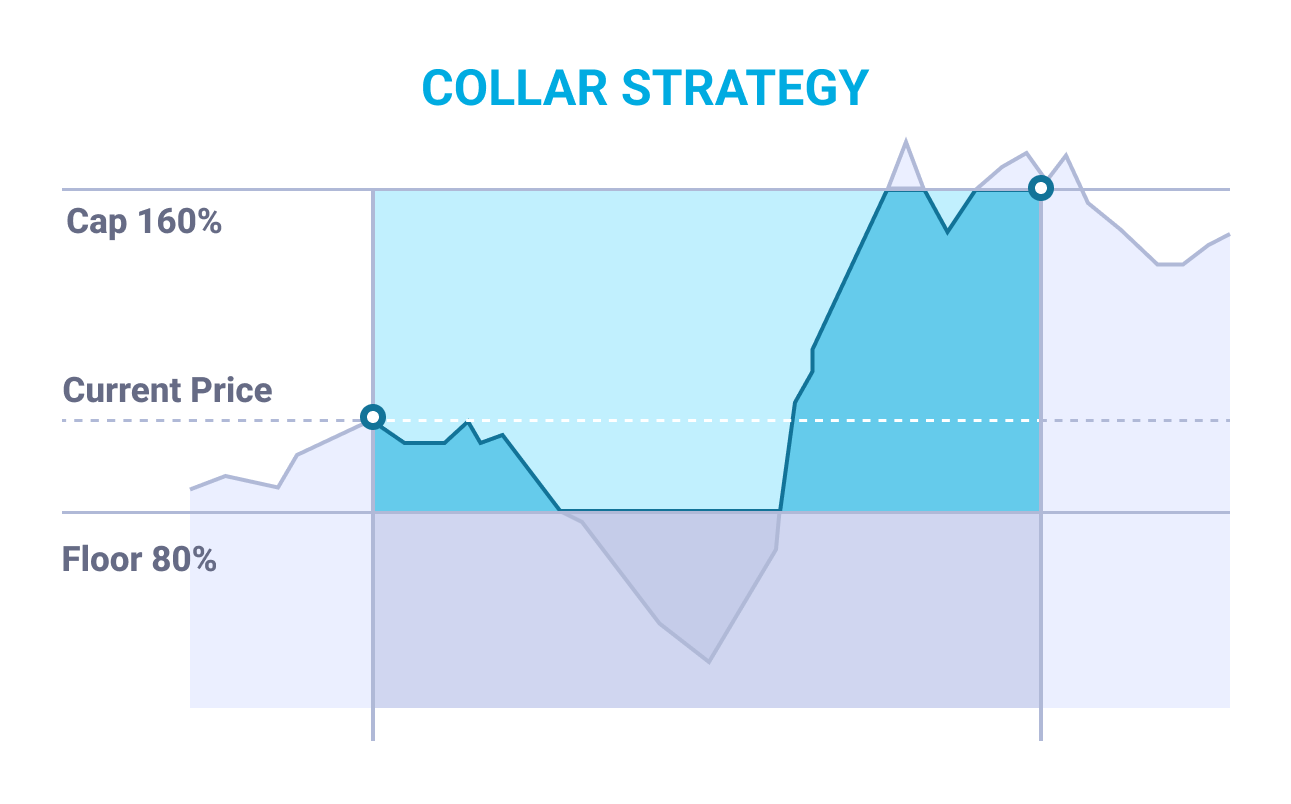

Using Collar Strategy in VPF Contracts

A collar is an options-based structure that combines selling a call option and buying a put option on the same stock. In a VPF, this collar is embedded directly into the contract rather than executed separately by the investor.

The put sets a floor (e.g., 80%), limiting how much downside the investor is exposed to.

The call sets a cap (e.g., 160%), limiting how much upside the investor can keep.

Together, the collar defines a bounded range of outcomes for the stock’s future value.

The collar is not primarily designed to benefit the investor, it exists to control the bank’s risk. When a financial institution advances 75–90% of the stock’s value upfront, it is exposed to downside risk: If the stock collapses, the institution will lose the money.

By buying a put option the bank protects the position against downside risk. The put option is not free and costs money. To offset this cost the financial institution sells a call option.

Insider Trader Policy

Many public-company employees are subject to insider trading policies that prohibit trading derivatives on company stock even if those derivatives are embedded inside a structured product like a VPF. In such cases, the investor needs to check with their employer and get approval before they enter into a VPF contract.

If the institution structures VPFs using European-style options (not American), with expiration dates that fall during an open trading window, the investor can avoid selling shares when the trading window is closed. However, this does not guarantee compliance. Ultimately, the employer’s insider-trading policy governs and the employer makes a decision.

Wait, How Can Floor Be Lower Than Cash Payment?

It’s a great question. If you asked it—congratulations. You already have a solid understanding of how VPFs work. If the stock falls below the cash payment, the bank loses money. But does the bank take that risk?

When banks enter into a VPF contract, they may hedge their exposure. In this case to offset the risk of the stock falling, the bank shorts a specific amount of that stock in the open market.

Why not simply match the floor and the cash value?

The institution wants to avoid creating a constructive sale under Internal Revenue Code §1259, which would force the investor to recognize gains immediately. A forward contract that requires delivery of a substantially fixed number of shares for a substantially fixed price can trigger constructive sale treatment. The IRS does not provide a clear formula (at least I wasn’t able to find one). Instead, it asks two practical questions:

Do you still meaningfully participate in the upside?

Do you still bear meaningful downside risk?

If the answer to those questions is “no,” you likely have a constructive sale.