People create irrevocable trusts to preserve and protect family wealth across multiple generations. A properly structured irrevocable trust keeps assets outside the heirs’ personal ownership, which helps shield those assets from creditors, lawsuits, divorces, and poor financial decisions by future beneficiaries.

However, the U.S. tax code can complicate this goal by forcing families to trade off asset protection against higher taxes.

Context

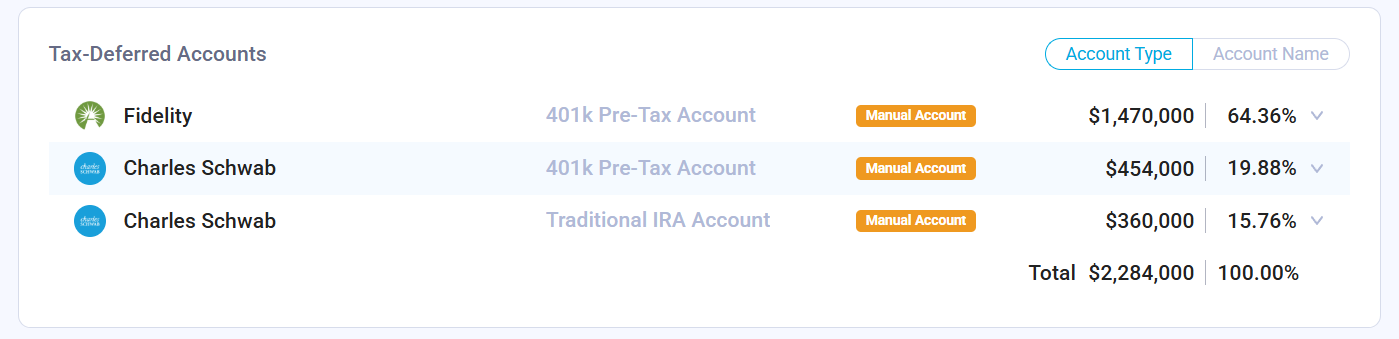

To illustrate this tradeoff, consider the following example. The family lives in California and works in tech. They have accumulated around $2.3M in tax-deferred retirement accounts: $1.9M in 401K Pre-Tax and $360K in Traditional IRA.

The family is working on setting up a Dynasty Trust to protect their wealth. Their plan is to move some of their assets into this trust and make their children beneficiaries. The family can’t move their IRA and 401K accounts into the trust: retirement accounts must remain owned by an individual. However, the family can name the trust as a beneficiary.

Compressed Tax Brackets for Trusts

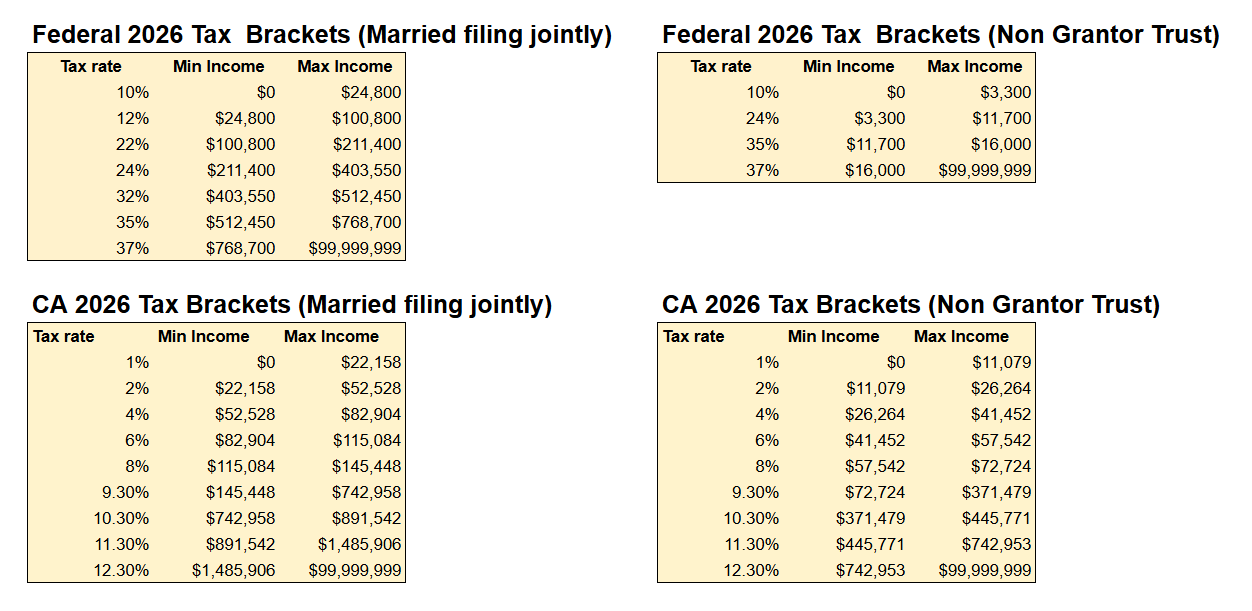

A trust can be designed either to distribute income to beneficiaries or retain it. If the trust is designed to retain income, the income is taxed using highly compressed federal tax brackets: the 37% tax rate starts at only $16,000 of income.

California doesn’t have separate tax brackets for trusts, but the state uses the same income tax rate schedules for trusts as it does for single individual filers, meaning trusts reach the highest tax brackets at much lower income levels than married couples filing jointly.

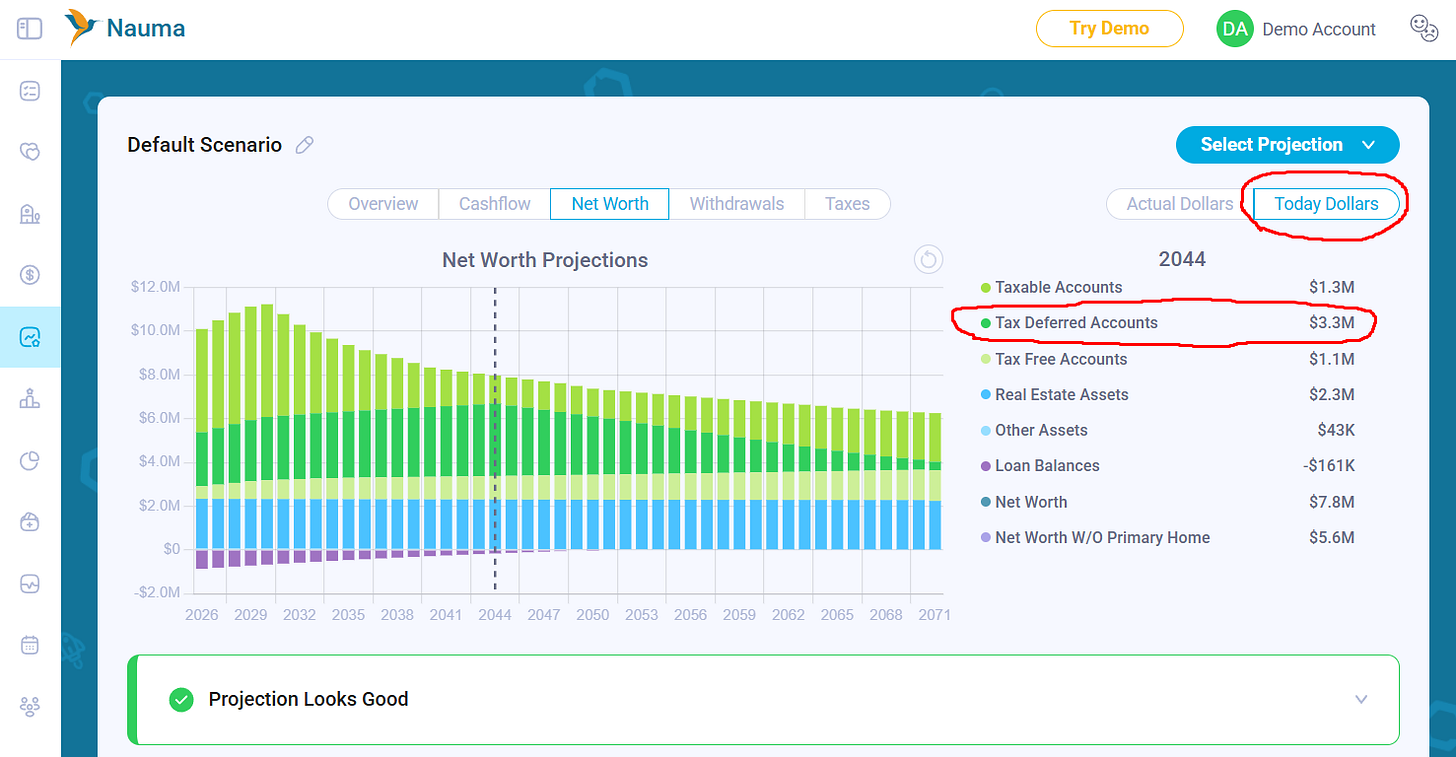

The family has their financial projection built, and they see that their tax-deferred retirement accounts are projected to grow from the current $2.3M to $3.3M in 2044 in today’s dollars. The value will start reducing over time and reach $392K at the end of the financial plan when partners turn 95.

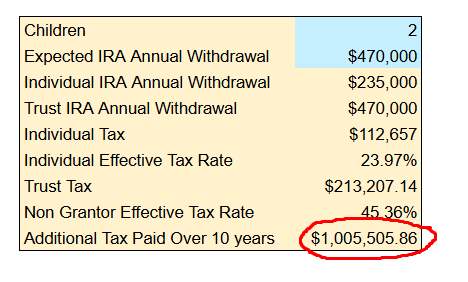

Non-spouse beneficiaries (including most trusts) must withdraw the entire account within 10 years. That means that the trust will need to withdraw between $56K and $470K annually (assuming a 7% annual growth rate)

The family has 2 children. When withdrawing $470K/year, the individual effective tax rate for a married couple filing jointly is 23.97% assuming that retirement accounts will be split 50/50 between kids. By contrast, for a trust that retains earnings and is subject to compressed trust tax brackets, the effective tax rate rises to 45.36% which results in $1M additional tax paid over 10 years:

Available Options

Given these tax dynamics, the family faces three primary options for their tax-deferred retirement accounts:

Option 1: Name children as beneficiaries

Each child inherits up to $1.65M (in today’s dollars), taxed at individual rates.

Option 2: Name the irrevocable trust as beneficiary and distribute income

Trust income flows through to beneficiaries, generating up to $235K per child per year of ordinary income.

Option 3: Name the irrevocable trust as beneficiary and retain income

Assets remain fully protected, but IRA withdrawals are taxed at compressed trust rates, resulting in approximately $1M of additional taxes over 10 years.

Naming a trust that retains earnings as the beneficiary of tax-deferred accounts provides the highest level of asset protection, but requires the family to pay the additional tax depending on the size of the inherited account. If asset protection is a priority and the family prefers the trust to retain income, the family can mitigate the tax cost by proactively reducing the size of tax-deferred accounts during their life:

Do Roth conversions earlier in life to reduce future withdrawals

Prioritize withdrawals from tax-deferred accounts in retirement over taxable and tax-free assets

Why the IRS Uses Compressed Tax Brackets for Trusts

The IRS uses compressed tax brackets for trusts because trusts are not meant to function as long-term tax shelters, and the tax code is designed to push income out of trusts and into individual beneficiaries’ tax returns.

Trusts exist primarily for asset protection, control, and administration, not as independent economic actors. If trusts were taxed using the same brackets as individuals, high-income families could accumulate income inside trusts indefinitely and avoid progressive taxation. Compressed brackets reduce the incentive to “park” income inside a trust.

Compressed tax brackets also help prevent income splitting across multiple trusts. Without compressed brackets, families could create many small non-grantor trusts and spread income across them to exploit lower brackets. The IRS also targets this behavior also via the multiple trust rule (IRC §643(f)), which allows the IRS to aggregate trusts created to avoid taxes.

Conclusion

The key takeaway is that the most important planning happens before assets are inherited. Families with substantial pre-tax retirement balances may benefit from evaluating how much of that wealth ultimately flows into a trust structure versus being taxed at individual rates. Decisions around beneficiary designations, Roth conversions, and withdrawal sequencing can materially change outcomes, but they require careful modeling and coordination with tax and estate planning professionals.

In short, dynasty trusts can be powerful tools for multigenerational wealth protection, but when retirement accounts are part of the picture, understanding and planning around compressed trust tax brackets is essential to avoiding unintended and costly tax outcomes.